Description

Virtual Prepaid Visa Credit Card

A virtual Virtual Prepaid Visa Credit Card is a convenient and secure payment solution that allows users to make online purchases without the need for a physical card. This document explores the features, benefits, and usage of Buy Virtual Prepaid Visa Credit Card, providing insights into how they can enhance your online shopping experience while maintaining financial security.

What is a Best Prepaid Virtual Visa Card?

Buy Virtual Prepaid Visa Credit Card is a card that does not itself issue credit or debit cards but partners with financial institutions that issue cards. Prepaid Visa Virtual Credit card bears the Visa symbol.

Visa’s journey begins in 1958, and it was established by Bank of America who launched the first consumer credit card program for middle-class consumers and small to medium-sized merchants in the U.S. It took quite a short time for the company to grow and the company expanded internationally in 1974.

Loaded card shown and proof loaded card.

In 1975, it introduced the debit card. Regional businesses worldwide were merged to form Visa Inc. in 2007, and the company went public in one of the largest IPOs in history in 2008. Visa also completed the acquisition of Visa Europe in 2016.

With more than 200 countries and territories with products and services available on any device such as cards, laptops, tablets and mobile devices visa simply is the best way to pay and be paid, for everyone, everywhere.

Advantages of Prepaid Visa Card

- For Visa cardholders, Cardholder Inquiry Service provides customer phone support for general inquiries and provides product or service information.

- Provided by Visa Global Customer Care Services, Visa offers 24-hour cardholder information and assistance by phone to all Visa cardholders calling from anywhere in the world.

- Visa will block your card when the card number is known and connect you with your financial institution or Bank. After bank approval, cardholders can also get an emergency card replacement within one to three business days. There is another option that Visa can arrange for cash to be available at a location near you, usually within hours of your bank’s approval.

- Visa Card also has the facility of receiving auto coverage for damage due to collision or theft.

- Visa’s Zero Liability Policy protects you from unauthorized charges if your card is lost or stolen. Whether the purchases occurred online or in person, you are 100% protected.

- With Continuous fraud monitoring service, Visa monitors activity on your ca

- rd around the clock to help detect suspicious activity.

- For Visa cardholder, you have access to Roadside Dispatch which is a pay-per-use roadside assistance program.

- Your card includes a 3-digit security code which is to verify your identity for phone or online purchases.

- You can Call anytime for Travel or Emergency Assistance, available for covered Visa cardholders from anywhere in the world.

- With the help of Prepaid Visa Card, you can get a detailed yearly report of your card spending to simplify budgeting and financial planning.

Key Benefits of Our Visa Account

Buy Virtual Prepaid Visa Credit Card with the best quality! We ensure an active and authentic account according to your demand. You can get the following benefits from our service-

- Card Anonymity – You can register under any name and address which allows you to keep your personal information hidden.

- Instant 24/7 Delivery – We provide the account right after your payment. So, you don’t have to wait for days to get your account verified.

- Worldwide Access – You can purchase from anyplace through our online service. We also accept all types of currency.

- We offer all types of Visa card accounts. Like Blue card account, Green card account, Brown card, and Black card account.

- Expiry date: The account will belong to you and you have access as long as you want. The card usually has an expiry date of 18-24 months. Sometimes it varies.

In what year was Virtual Prepaid Visa Credit Card made

Buy Virtual Prepaid Visa Credit Card, The concept of Virtual Prepaid Visa Credit Card has been around for quite some time now, with its origins dating back to the early 2000s. The first Prepaid Visa Card was introduced as a way to provide consumers with a convenient and secure alternative to carrying cash or using traditional credit cards. In 1999, Visa launched the first generation of Prepaid Visa Cards, allowing consumers to load funds onto a plastic card and use it to make purchases at various merchants and retailers.

This innovative payment solution quickly gained popularity among consumers who were looking for a more flexible and convenient way to manage their finances. Over the years, Prepaid Visa Cards have evolved to offer a wide range of features and benefits, including the ability to make purchases online, access to ATMs for cash withdrawals, and even the option to reload funds onto the card as needed. Today, Prepaid Visa Cards are widely accepted around the world, making them a convenient and versatile payment option for consumers of all ages. The convenience and security of Buy Virtual Prepaid Visa Credit Card have made them a popular choice for consumers who want to maximize their spending power without the risk of overspending or accruing debt.

Buy Visa Prepaid Cards

Visa prepaid cards are becoming increasingly popular for online purchases, budgeting, gifting, and even business expenses. Whether you’re looking for a safer way to shop online or a convenient gift option, buying a Visa prepaid card can be a smart choice. In this article, we’ll explore the key reasons to buy a Visa prepaid card, where to get one, and the benefits it offers.

Buy Visa prepaid card is a flexible, secure, and easy way to manage money without the need for a bank account or credit check. Whether you’re shopping online, sending a gift, or setting a budget for a specific expense, Visa prepaid cards offer a reliable solution that’s accepted worldwide. Make sure to compare fees, features, and terms before purchasing to get the best value for your needs.

With a Prepaid Visa Card, you can easily track your spending and budget more effectively, helping you stay on top of your finances and avoid unnecessary fees or charges. Whether you’re looking for a way to manage your everyday expenses, travel abroad, or shop online, a Prepaid Visa Card can help you make the most of your money and take control of your financial future. So if you’re ready to maximize your spending power and enjoy the benefits of a convenient payment solution, consider getting a Prepaid Visa Card today, Buy Virtual Prepaid Visa Credit Card.

Features of Virtual Prepaid Visa Credit Card

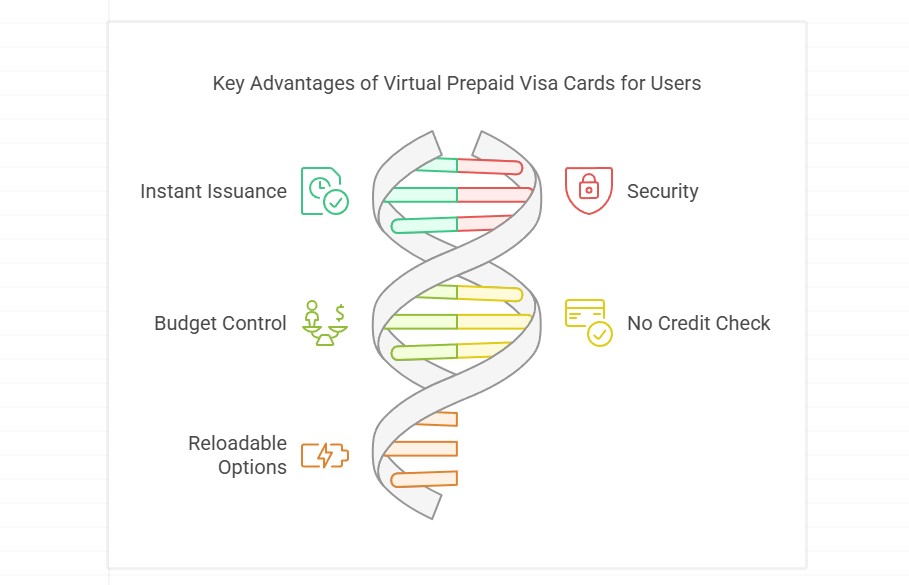

- Instant Issuance: Many providers offer instant issuance of virtual cards, allowing users to receive their card details immediately after purchase.

- Security: Virtual cards provide an added layer of security for online transactions, as users do not need to share their actual credit card information.

- Budget Control: Since these cards are prepaid, users can only spend the amount loaded onto the card, helping to manage budgets and avoid overspending.

- No Credit Check: Virtual prepaid cards typically do not require a credit check, making them accessible to individuals with no credit history or poor credit scores.

- Reloadable Options: Some virtual prepaid cards can be reloaded, allowing users to add funds as needed.

Benefits of Using a Virtual Prepaid Visa Credit Card

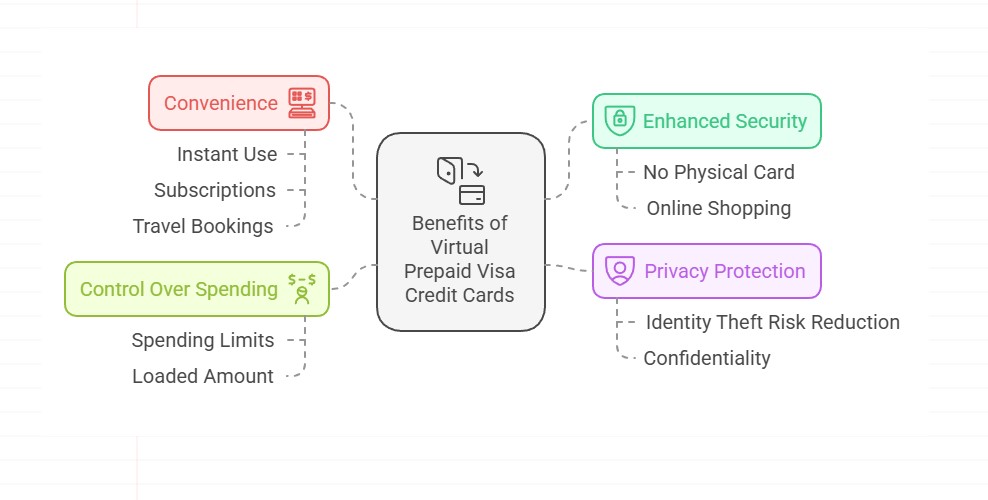

- Enhanced Security: With no physical card to lose or steal, users can shop online with peace of mind.

- Privacy Protection: Users can keep their personal banking information private, reducing the risk of identity theft.

- Convenience: Ideal for online shopping, subscriptions, and travel bookings, virtual cards can be used instantly without waiting for a physical card to arrive.

- Control Over Spending: Users can set limits on their spending by controlling the amount loaded onto the card.

How to Obtain a Virtual Prepaid Visa Credit Card

- Choose a Provider: Research and select a financial institution or online service that offers virtual prepaid Visa cards.

- Create an Account: Sign up for an account with the chosen provider, providing necessary personal information.

- Load Funds: Add funds to your virtual card using a bank transfer, debit card, or other accepted payment methods.

- Receive Card Details: Once the funds are loaded, you will receive your virtual card number, expiration date, and CVV code, which can be used for online purchases.

“Maximize Your Spending Power with a Virtual Prepaid Visa Credit Card”

Buy Virtual Prepaid Visa Credit Card, In today’s fast-paced world, convenience is king. And when it comes to managing your finances, nothing beats the ease and flexibility of a prepaid Visa card. Whether you’re a seasoned budgeter looking to streamline your spending or a newbie to the world of personal finance, a prepaid Visa card can help you maximize your purchasing power while keeping your funds secure. With a prepaid Visa card, you can say goodbye to the hassle of carrying around cash or worrying about overspending on your credit card. Simply load funds onto your card, and you’re ready to shop, dine out, or pay bills online with ease. Plus, Buy Virtual Prepaid Visa Credit Card for sale are widely accepted at millions of locations worldwide, making them a convenient and versatile option for managing your money. So why wait? Discover the benefits of a prepaid Visa card for yourself and take control of your finances today, Buy Virtual Prepaid Visa Credit Card.

Virtual Prepaid Visa Credit Card Details In what year was Virtual Prepaid Visa Credit Card made What are Buy Virtual Prepaid Visa Credit Card benefits What is the use of Virtual Prepaid Visa Credit Card Shopping can be done using Buy Virtual Prepaid Visa Credit Card.

Buy Best Prepaid Visa Card, If you’re looking to maximize your spending power and take control of your finances, a prepaid Visa card might be the perfect solution for you. Prepaid Visa cards function like a traditional debit or credit card, but with a few key differences that can make managing your money easier and more convenient. One of the main advantages of using a prepaid Visa card is that it allows you to only spend the amount of money that you have loaded onto the card. This can be particularly helpful if you’re trying to stick to a budget or avoid overspending.

With a Virtual Prepaid Visa Credit Card, you won’t have to worry about going into debt or accruing interest charges because you can only spend what you have already deposited onto the card. Another benefit of using a prepaid Visa card is that it can help you track your spending more easily. Many prepaid Visa cards come with online account management tools that allow you to monitor your transactions, check your balance, and set up alerts for when your balance gets low. This can be a helpful way to stay on top of your finances and avoid any surprises when it comes to your spending. Virtual Prepaid Visa Credit Card also offer a level of security that cash simply can’t match. If your card is lost or stolen, you can contact the card issuer to have the card deactivated and replaced, preventing any unauthorized charges from being made. Additionally, because prepaid Visa cards are not linked to your bank account, using one can help protect your personal information and prevent fraud. While prepaid Visa cards offer many benefits, it’s important to be aware of the fees that may be associated with using one.

These fees can vary depending on the card issuer, so it’s a good idea to read the terms and conditions carefully before applying for a card. Some common fees to look out for include monthly maintenance fees, ATM withdrawal fees, and reloading fees. By understanding the fee structure of the prepaid Visa card you choose, you can avoid any surprise charges and make the most of your card. In conclusion, a prepaid Visa card can be a valuable tool for maximizing your spending power and taking control of your finances. With features like spending control, easy tracking, and enhanced security, using a prepaid Visa card can help you manage your money more effectively. Just be sure to review the fees associated with the card to ensure that it aligns with your financial goals.

In what year was Virtual Prepaid Visa Credit Card made

Virtual Prepaid Visa Credit Card, The concept of Prepaid Visa Cards has been around for quite some time now, with its origins dating back to the early 2000s. The first Prepaid Visa Card was introduced as a way to provide consumers with a convenient and secure alternative to carrying cash or using traditional credit cards. In 1999, Visa launched the first generation of Prepaid Visa Cards, allowing consumers to load funds onto a plastic card and use it to make purchases at various merchants and retailers.

This innovative payment solution quickly gained popularity among consumers who were looking for a more flexible and convenient way to manage their finances. Over the years, Prepaid Visa Cards have evolved to offer a wide range of features and benefits, including the ability to make purchases online, access to ATMs for cash withdrawals, and even the option to reload funds onto the card as needed. Today, Prepaid Visa Cards are widely accepted around the world, making them a convenient and versatile payment option for consumers of all ages. The convenience and security of Prepaid Visa Cards have made them a popular choice for consumers who want to maximize their spending power without the risk of overspending or accruing debt.

With a Virtual Prepaid Visa Credit Card, you can easily track your spending and budget more effectively, helping you stay on top of your finances and avoid unnecessary fees or charges. Whether you’re looking for a way to manage your everyday expenses, travel abroad, or shop online, a Prepaid Visa Card can help you make the most of your money and take control of your financial future. So if you’re ready to maximize your spending power and enjoy the benefits of a convenient payment solution, consider getting a Prepaid Visa Card today, Buy Best Prepaid Visa Card.

Ways to reload your Virtual Prepaid Visa Credit Card

Buy Virtual Prepaid Visa Credit Card, Prepaid Visa cards are a convenient way to manage your finances and control your spending. However, in order to make the most of your card, you need to ensure it is always loaded with funds. There are multiple ways to reload your Prepaid Visa card, making it easy to keep your card topped up and ready to use whenever you need it. One of the most common ways to reload your Prepaid Visa card is to set up direct deposit. This can be done through your employer or by linking your card to a government benefits program. With direct deposit, your funds are automatically loaded onto your card on a regular basis, making it quick and hassle-free to keep your card funded.

If direct deposit is not an option for you, another method to reload your Prepaid Visa card is to transfer funds from your checking or savings account. Many card issuers offer online portals or mobile apps that allow you to easily transfer money from your bank account to your Prepaid Visa card. This can be done manually whenever you need to add funds to your card, giving you flexibility and control over your finances. For those who prefer to load their Prepaid Visa card with cash, many retailers and financial institutions offer cash reload options. Simply visit a participating location and hand over your cash along with your Prepaid Visa card, and the funds will be added to your card instantly. This is a convenient option for those who prefer to use cash for their transactions and do not have access to a bank account for transfers. If you prefer to manage your finances on the go, some Prepaid Visa cards offer the option to reload funds through a mobile app. Simply download the app, link your card, and transfer funds from your bank account or credit card directly to your Prepaid Visa card.

This option is convenient for those who are always on the move and need a quick and easy way to load funds onto their card. Additionally, some Prepaid Visa cards offer the option to reload funds through a money transfer service such as Western Union or MoneyGram. Simply visit a participating location, provide your card information, and transfer funds from your bank account or cash to your Prepaid Visa card. This option is useful for those who do not have access to traditional banking services or prefer to load their card in person. In conclusion, there are multiple ways to reload your Prepaid Visa card, making it easy to keep your card funded and ready to use. Whether you prefer direct deposit, bank transfers, cash reloads, mobile app transfers, or money transfer services, there is an option that suits your needs and lifestyle. By staying on top of reloading your Prepaid Visa card, you can maximize your spending power and make the most of this convenient financial tool.

Shopping can be done using Virtual Prepaid Visa Credit Card

When it comes to shopping, having a Buy Virtual Prepaid Visa Credit Card. Not only does it offer convenience and security, but it also enables you to maximize your spending power and make the most out of your purchases. With a prepaid Visa card, you can shop at millions of locations that accept Visa, both online and in-store. This gives you the flexibility to make purchases wherever and whenever you want, without having to worry about carrying cash or using your regular credit or debit card. One of the key benefits of using a prepaid Visa card for shopping is the ability to set a specific budget for your purchases. By loading a predetermined amount of money onto the card, you can avoid overspending and stay within your financial limits.

This can be especially helpful when it comes to managing your budget for groceries, clothing, or other everyday expenses. Additionally, using a prepaid Visa card can help you stay on track with your financial goals. Since the card is not tied to a traditional bank account or line of credit, you can avoid accumulating debt and paying interest on your purchases. This can be particularly useful if you are trying to save money, build credit, or stick to a budget. Another advantage of using a prepaid Visa card for shopping is the added security it provides. With features such as fraud protection, zero liability for unauthorized transactions, and secure online shopping capabilities, you can shop with peace of mind knowing that your personal and financial information is protected. Furthermore, using a prepaid Visa card can also help you earn rewards and discounts on your purchases.

Many prepaid card issuers offer perks such as cashback, points, or discounts at participating retailers, which can help you save money and maximize your spending power in the long run. Overall, shopping with a prepaid Visa card can be a convenient and cost-effective way to make purchases, both big and small. Whether you are buying groceries, clothes, electronics, or anything in between, having a prepaid Visa card in your wallet can simplify the shopping process and help you make the most out of your money. So next time you head out to the store or browse online for your favorite items, consider using a prepaid Visa card to maximize your spending power and enjoy a hassle-free shopping experience. With its convenience, security, and money-saving benefits, a prepaid Visa card can be a valuable tool for smart and savvy shoppers everywhere.

In conclusion, utilizing a prepaid Visa card can be a convenient and effective way to manage your spending and budget more efficiently. With the ability to easily load funds and control your expenses, you can maximize your purchasing power while avoiding debt and overspending. Whether you’re looking to stick to a strict budget, safeguard against fraud, or simply enjoy the convenience of a credit card without the risk, a prepaid Visa card can be a smart financial tool to help you make the most of your money.

How to choose the right Virtual Prepaid Visa Credit Card for you

Choosing the right prepaid Visa card can make a significant difference in how you manage your finances. With so many options available in the market, it can be overwhelming to select the one that best suits your needs. Here are some factors to consider when choosing a prepaid Visa card: First and foremost, determine how you plan to use the card. Are you looking for a card to use for everyday purchases, or do you need it for specific purposes such as international travel or online shopping? Understanding your spending habits and preferences will help you narrow down your options and choose a card that aligns with your needs. Next, consider the fees associated with the card. Some prepaid Visa cards charge a monthly maintenance fee, transaction fees, ATM fees, and reload fees.

Make sure to read the terms and conditions carefully to understand the fee structure and determine if it fits within your budget. Look for cards with transparent fee structures and minimal charges to maximize your spending power. It is also essential to look for features that are important to you. For example, if you travel frequently, look for a card that offers travel insurance, roadside assistance, or purchase protection benefits. If you want to build credit, consider a prepaid Visa card that reports your payment history to credit bureaus. Take the time to research different card options and compare their features to find the one that offers the benefits you value the most. Another factor to consider is the card’s security features. Look for a prepaid Visa card that offers fraud protection, zero liability for unauthorized transactions, and secure online account management.

These features can help safeguard your funds and protect you from potential losses due to identity theft or fraud. Furthermore, consider the card issuer’s reputation and customer service. Choose a prepaid Visa card from a reputable financial institution that has a track record of providing quality services and support to its customers. Read reviews and testimonials from other cardholders to get a sense of the issuer’s reliability and commitment to customer satisfaction. Lastly, make sure to review the card’s reload options and accessibility. Some prepaid Visa cards offer multiple ways to reload funds, such as direct deposit, bank transfers, mobile check deposits, or in-person cash reloads. Choose a card that provides convenient and hassle-free reload options to ensure you can access your funds easily and efficiently. In conclusion, selecting the right prepaid Visa card requires careful consideration of your spending habits, fee structure, features, security, issuer reputation, and reload options. By taking the time to research and compare different card options, you can maximize your spending power and make the most of your prepaid Visa card. Choose a card that aligns with your financial goals and preferences to help you manage your finances effectively and confidently.

Managing your budget effectively with a Virtual Prepaid Visa Credit Card

Managing your budget effectively is crucial to reaching your financial goals. One tool that can help you stay on track is a prepaid Visa card. Unlike a traditional credit card, a prepaid Visa card allows you to spend only the amount of money that you have loaded onto the card in advance. This can be a great way to avoid overspending and keep your budget in check. One of the key benefits of using a prepaid Visa card to manage your budget is that it can help you stick to a set spending limit. By loading a specific amount of money onto the card, you are limiting yourself to only being able to spend that amount.

This can prevent impulse purchases and help you avoid going over budget. Additionally, a prepaid Visa card can also be a useful tool for tracking your expenses. Most prepaid cards come with online account management tools that allow you to monitor your spending in real-time. This can help you see where your money is going and identify any areas where you may be overspending. Another advantage of using a prepaid Visa card is that it can help you avoid accruing debt. Because you are only able to spend the money that you have loaded onto the card, you do not have the ability to carry a balance or accumulate interest charges like you would with a traditional credit card. This can be especially helpful for those who are trying to get out of debt or rebuild their credit. Furthermore, a prepaid Visa card can also be a safe and convenient way to make purchases.

You can use the card for online shopping, in-store purchases, and even to pay bills. Many prepaid cards also come with fraud protection features that can help safeguard your money in the event that your card is lost or stolen. In addition to these benefits, using a prepaid Visa card can also help you build good financial habits. By only being able to spend what you have loaded onto the card, you are forced to be more mindful of your purchases and make more conscious spending decisions. This can help you develop a stronger sense of discipline when it comes to managing your money. Overall, a prepaid Visa card can be a valuable tool for managing your budget effectively. By setting spending limits, tracking expenses, and avoiding debt, you can maximize your spending power and work towards achieving your financial goals. So if you are looking for a way to stay on budget and make smarter financial decisions, consider using a prepaid Visa card to help you take control of your finances, Buy Virtual Prepaid Visa Credit Card.

Safety and security features of Virtual Prepaid Visa Credit Card

When it comes to managing your finances, safety and security are top priorities. Buy Virtual Prepaid Visa Credit Card offer several features to help safeguard your money and personal information. One key aspect of prepaid Visa cards is that they are not linked to your bank account. This means that if your card is lost or stolen, the thief cannot access the funds in your bank account. You can simply report the card as lost or stolen and have it deactivated without affecting your other accounts. Additionally, prepaid Visa cards have built-in fraud protection measures.

Visa has a zero liability policy, which means that you won’t be held responsible for unauthorized charges made with your card. If you notice any suspicious activity on your account, you can report it to the card issuer and they will investigate the matter. Many Virtual Prepaid Visa Credit Card also offer the option to set up alerts for transactions. This allows you to receive notifications via text or email whenever a purchase is made with your card. If you see a transaction that you didn’t authorize, you can take immediate action to protect your funds. Another security feature of prepaid Visa cards is the ability to set spending limits.

You can preload a specific amount onto the card, limiting the risk of overspending. Once the funds are used up, you can reload the card with more money as needed. Buy Virtual Prepaid Visa Credit Card also offer secure online shopping capabilities. When making purchases online, you can use a virtual card number instead of your physical card number. This helps protect your personal information from falling into the wrong hands. Furthermore, prepaid Visa cards are issued with EMV chip technology. These chips add an extra layer of security to in-person transactions by creating a unique code for each purchase. This makes it more difficult for fraudsters to clone your card or make unauthorized transactions. In the event that you do encounter any issues with your prepaid Visa card, most issuers offer round-the-clock customer support. You can easily reach out for assistance with any questions or concerns about your account.

Buy Virtual prepaid Visa credit cards offer a flexible and secure way to manage online spending. With their instant issuance, enhanced security features, and budget control capabilities, they are an excellent choice for anyone looking to shop online safely. Whether for personal use or as a gift, Buy Virtual Prepaid Visa Credit Card provide a modern solution to everyday financial transactions.

Sara MIlnes –

I do appreciate that this platform made it easy for me to buy an Visa card , however I think the fees are expensive – I paid $450.00 to buy a $400.00 Visa. card But All Good

vccplus.com –

Thank You sir

Walli –

nice Virtual Prepaid Visa Credit Card, Good Delivery my card $500 Virtual Prepaid Visa Credit Card worked for my project

Vccplus.com –

Thank You sir

Robert –

Fast delivery, legit $300 Virtual Prepaid Visa Credit Card, no hassle. Got my Card instantly and it worked perfectly. Will definitely buy again. 5/5.

Vccplus.com –

Thank you for your review.

SALLY GOUNDEN –

Love this site Vccplus. Was the best site so far and quickly my $200 Virtual Prepaid Visa Credit Card was delivered to.my email.

Vccplus.com –

Thank you for your review.

Sylvia Burr –

New to your web site pretty simple to get a Virtual Prepaid Visa Credit Card. Easy to navigate the site. Another chance to shine good job.

Vccplus.com –

Thank you for your review.

Heyo WasHere –

bought a $500 Virtual Prepaid Visa Credit Card, no issues at all

Vccplus.com –

Thank you for your review.