Buy Best Prepaid Visa Card

What is a Best Prepaid Virtual Visa Card?

Buy Best Prepaid Visa Card, A prepaid virtual Visa card is a digital payment card that can be loaded with funds in advance and used for online transactions. It operates like a regular Visa card but does not have a physical counterpart. Here’s a brief overview of prepaid virtual Visa cards:

“Maximize Your Spending Power with a Prepaid Visa Card”

Buy Best Prepaid Visa Card Best loaded Prepaid Visa Card for sale, In today’s fast-paced world, convenience is king. And when it comes to managing your finances, nothing beats the ease and flexibility of a prepaid Visa card. Whether you’re a seasoned budgeter looking to streamline your spending or a newbie to the world of personal finance, a prepaid Visa card can help you maximize your purchasing power while keeping your funds secure. With a prepaid Visa card, you can say goodbye to the hassle of carrying around cash or worrying about overspending on your credit card. Simply load funds onto your card, and you’re ready to shop, dine out, or pay bills online with ease. Plus, Buy Best Prepaid Visa Card Best loaded Prepaid Visa Card for sale are widely accepted at millions of locations worldwide, making them a convenient and versatile option for managing your money. So why wait? Discover the benefits of a prepaid Visa card for yourself and take control of your finances today,Buy Best Prepaid Visa Card

Prepaid Visa Card Details In what year was Prepaid Visa Card made What are Prepaid Visa Card benefits What is the use of Prepaid Visa Card Shopping can be done using Prepaid Visa Card

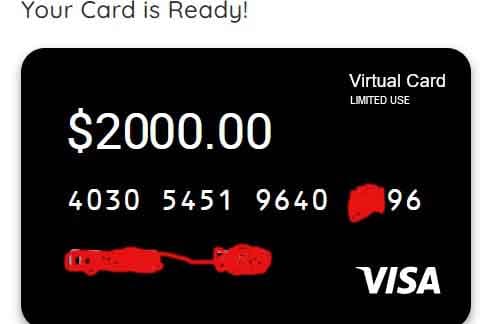

Loaded card shown and proof loaded card.

Quantity and price You can buy or get a loaded card from us

The cost of a prepaid Visa card

Our cards have been created for web sites and shopping and can be used for any purpose.

| Loaded Amount | Price | Pay by contact |

| Balance: $ 10 | $ 16.00 | Pay by contact |

| Balance: $ 25 | $ 32.00 | Pay by contact |

| Balance: $ 50 | $ 58.00 | Pay by contact |

| Balance: $ 100 | $ 120.00 | Pay by contact |

| Balance: $ 200 | $ 222.00 | Pay by contact |

| Balance: $ 300 | $ 320.00 | Pay by contact |

| Balance: $ 500 | $ 520.00 | Pay by contact |

| Balance: $ 1000 | $ 1015.00 | Pay by contact |

| Balance: $ 2000 | $ 2020.00 | Pay by contact |

| Balance: $ 5000 | $ 5025.00 | Pay by contact |

| Maximum Card Balance: $ 85000 | $ 85055.00 | Pay by contact |

Buy Best Prepaid Visa Card, If you’re looking to maximize your spending power and take control of your finances, a prepaid Visa card might be the perfect solution for you. Prepaid Visa cards function like a traditional debit or credit card, but with a few key differences that can make managing your money easier and more convenient. One of the main advantages of using a prepaid Visa card is that it allows you to only spend the amount of money that you have loaded onto the card. This can be particularly helpful if you’re trying to stick to a budget or avoid overspending.

With a prepaid Visa card, you won’t have to worry about going into debt or accruing interest charges because you can only spend what you have already deposited onto the card. Another benefit of using a prepaid Visa card is that it can help you track your spending more easily. Many prepaid Visa cards come with online account management tools that allow you to monitor your transactions, check your balance, and set up alerts for when your balance gets low. This can be a helpful way to stay on top of your finances and avoid any surprises when it comes to your spending. Prepaid Visa cards also offer a level of security that cash simply can’t match. If your card is lost or stolen, you can contact the card issuer to have the card deactivated and replaced, preventing any unauthorized charges from being made. Additionally, because prepaid Visa cards are not linked to your bank account, using one can help protect your personal information and prevent fraud. While prepaid Visa cards offer many benefits, it’s important to be aware of the fees that may be associated with using one.

These fees can vary depending on the card issuer, so it’s a good idea to read the terms and conditions carefully before applying for a card. Some common fees to look out for include monthly maintenance fees, ATM withdrawal fees, and reloading fees. By understanding the fee structure of the prepaid Visa card you choose, you can avoid any surprise charges and make the most of your card. In conclusion, a prepaid Visa card can be a valuable tool for maximizing your spending power and taking control of your finances. With features like spending control, easy tracking, and enhanced security, using a prepaid Visa card can help you manage your money more effectively. Just be sure to review the fees associated with the card to ensure that it aligns with your financial goals.

In what year was Prepaid Visa Card made

Buy Best Prepaid Visa Card Best loaded Prepaid Visa Card for sale, The concept of Prepaid Visa Cards has been around for quite some time now, with its origins dating back to the early 2000s. The first Prepaid Visa Card was introduced as a way to provide consumers with a convenient and secure alternative to carrying cash or using traditional credit cards. In 1999, Visa launched the first generation of Prepaid Visa Cards, allowing consumers to load funds onto a plastic card and use it to make purchases at various merchants and retailers.

This innovative payment solution quickly gained popularity among consumers who were looking for a more flexible and convenient way to manage their finances. Over the years, Prepaid Visa Cards have evolved to offer a wide range of features and benefits, including the ability to make purchases online, access to ATMs for cash withdrawals, and even the option to reload funds onto the card as needed. Today, Prepaid Visa Cards are widely accepted around the world, making them a convenient and versatile payment option for consumers of all ages. The convenience and security of Prepaid Visa Cards have made them a popular choice for consumers who want to maximize their spending power without the risk of overspending or accruing debt.

With a Prepaid Visa Card, you can easily track your spending and budget more effectively, helping you stay on top of your finances and avoid unnecessary fees or charges. Whether you’re looking for a way to manage your everyday expenses, travel abroad, or shop online, a Prepaid Visa Card can help you make the most of your money and take control of your financial future. So if you’re ready to maximize your spending power and enjoy the benefits of a convenient payment solution, consider getting a Prepaid Visa Card today, Buy Best Prepaid Visa Card.

What are Prepaid Visa Card benefits

Buy Best Prepaid Visa Card Best loaded Prepaid Visa Card for sale, Prepaid Visa cards are a convenient and versatile payment option that offer a wide range of benefits for consumers. One of the main advantages of using a prepaid Visa card is the ability to control and budget your spending. With a prepaid card, you can only spend the amount of money that has been loaded onto the card, which can help you avoid overspending and accumulating debt. Another benefit of using a prepaid Visa card is the convenience and flexibility it offers. Unlike traditional credit cards, prepaid cards do not require a credit check or bank account, making them accessible to a wider range of consumers, including those with poor credit or no credit history.

Prepaid cards can be easily loaded with funds either online, at retail locations, or through direct deposit, giving you the flexibility to choose the method that works best for you. Prepaid Visa cards are also a great option for those who prefer to shop online or make purchases in stores without the need to carry cash. With a prepaid card, you can make secure payments at millions of locations worldwide that accept Visa cards, including online retailers, restaurants, and grocery stores. Many prepaid cards also come with the added benefit of purchase protection, which can help safeguard your funds in case of theft or loss. In addition to their convenience and security features, prepaid Visa cards can also be a useful tool for managing your finances. By using a prepaid card for your daily expenses, you can track your spending more easily and monitor your budget more effectively.

Many prepaid cards come with online account management tools that allow you to check your balance, track your transactions, and set spending limits, helping you stay on top of your finances and avoid overspending. Prepaid Visa cards are also a great option for travel and international transactions. Many prepaid cards offer competitive exchange rates and low fees for purchases made abroad, making them a cost-effective alternative to traditional credit cards or cash when traveling. Additionally, prepaid cards can provide added security when traveling, as they are not linked to your bank account and can be easily replaced if lost or stolen. Overall, prepaid Visa cards offer a wide range of benefits for consumers, including budget control, convenience, security, and financial management. Whether you are looking for a versatile payment option, a tool for managing your finances, or a secure way to make purchases while traveling, a prepaid Visa card can be a valuable addition to your wallet. With the ability to maximize your spending power and enjoy the benefits of a Visa card without the need for a bank account or credit check, prepaid cards are a smart choice for consumers looking for a flexible and convenient payment solution, Buy Best Prepaid Visa Card Best loaded Prepaid Visa Card for sale.

Ways to reload your Prepaid Visa Card

Buy Best Prepaid Visa Card, Prepaid Visa cards are a convenient way to manage your finances and control your spending. However, in order to make the most of your card, you need to ensure it is always loaded with funds. There are multiple ways to reload your Prepaid Visa card, making it easy to keep your card topped up and ready to use whenever you need it. One of the most common ways to reload your Prepaid Visa card is to set up direct deposit. This can be done through your employer or by linking your card to a government benefits program. With direct deposit, your funds are automatically loaded onto your card on a regular basis, making it quick and hassle-free to keep your card funded.

If direct deposit is not an option for you, another method to reload your Prepaid Visa card is to transfer funds from your checking or savings account. Many card issuers offer online portals or mobile apps that allow you to easily transfer money from your bank account to your Prepaid Visa card. This can be done manually whenever you need to add funds to your card, giving you flexibility and control over your finances. For those who prefer to load their Prepaid Visa card with cash, many retailers and financial institutions offer cash reload options. Simply visit a participating location and hand over your cash along with your Prepaid Visa card, and the funds will be added to your card instantly. This is a convenient option for those who prefer to use cash for their transactions and do not have access to a bank account for transfers. If you prefer to manage your finances on the go, some Prepaid Visa cards offer the option to reload funds through a mobile app. Simply download the app, link your card, and transfer funds from your bank account or credit card directly to your Prepaid Visa card.

This option is convenient for those who are always on the move and need a quick and easy way to load funds onto their card. Additionally, some Prepaid Visa cards offer the option to reload funds through a money transfer service such as Western Union or MoneyGram. Simply visit a participating location, provide your card information, and transfer funds from your bank account or cash to your Prepaid Visa card. This option is useful for those who do not have access to traditional banking services or prefer to load their card in person. In conclusion, there are multiple ways to reload your Prepaid Visa card, making it easy to keep your card funded and ready to use. Whether you prefer direct deposit, bank transfers, cash reloads, mobile app transfers, or money transfer services, there is an option that suits your needs and lifestyle. By staying on top of reloading your Prepaid Visa card, you can maximize your spending power and make the most of this convenient financial tool.

What is the use of Prepaid Visa Card

Buy Best Prepaid Visa Card Best loaded Prepaid Visa Card for sale, A prepaid Visa card is a convenient and versatile tool that can help you manage your finances more efficiently. Unlike traditional credit cards, prepaid Visa cards are not linked to a bank account or credit line. Instead, you load money onto the card in advance, and then use it to make purchases just like you would with a credit card. One of the main uses of a prepaid Visa card is to help you stick to a budget. By loading only a set amount of money onto the card, you can prevent overspending and better control your expenses. This can be especially helpful for those who struggle to stay within their budget or who want to limit their spending on certain categories, such as entertainment or dining out.

Prepaid Visa cards are also a great option for those who want to make online purchases but are wary of using their regular credit or debit cards. Since prepaid Visa cards are not tied to a bank account, they provide an added layer of security when shopping online. You can use the card to make purchases on websites without worrying about exposing your personal or financial information. Another benefit of using a prepaid Visa card is the ability to easily track your spending. Many prepaid card providers offer online account management tools that allow you to check your balance, review your transaction history, and set up alerts for when your balance is low. This can help you stay on top of your finances and avoid any surprises when it comes time to pay the bill. Prepaid Visa cards are also a useful tool for travelling. Instead of carrying around large amounts of cash or relying on your regular debit or credit card while abroad, you can load money onto a prepaid Visa card and use it for purchases and ATM withdrawals.

This can help you avoid foreign transaction fees and provide added security in case your card is lost or stolen. In addition to these practical uses, prepaid Visa cards can also be a useful financial planning tool. If you want to set aside money for a specific goal, such as a vacation or a major purchase, you can load funds onto a prepaid card and track your progress towards your savings goal. This can help you stay motivated and disciplined in your savings efforts. Overall, a prepaid Visa card can be a valuable tool for managing your finances, sticking to a budget, and staying on top of your spending. Whether you want to control your spending, shop online securely, track your expenses, or save for a specific goal, a prepaid Visa card can help you maximize your spending power and achieve your financial objectives.

Shopping can be done using Prepaid Visa Card

When it comes to shopping, having a Buy Best Prepaid Visa Card Best loaded Prepaid Visa Card for sale. Not only does it offer convenience and security, but it also enables you to maximize your spending power and make the most out of your purchases. With a prepaid Visa card, you can shop at millions of locations that accept Visa, both online and in-store. This gives you the flexibility to make purchases wherever and whenever you want, without having to worry about carrying cash or using your regular credit or debit card. One of the key benefits of using a prepaid Visa card for shopping is the ability to set a specific budget for your purchases. By loading a predetermined amount of money onto the card, you can avoid overspending and stay within your financial limits.

This can be especially helpful when it comes to managing your budget for groceries, clothing, or other everyday expenses. Additionally, using a prepaid Visa card can help you stay on track with your financial goals. Since the card is not tied to a traditional bank account or line of credit, you can avoid accumulating debt and paying interest on your purchases. This can be particularly useful if you are trying to save money, build credit, or stick to a budget. Another advantage of using a prepaid Visa card for shopping is the added security it provides. With features such as fraud protection, zero liability for unauthorized transactions, and secure online shopping capabilities, you can shop with peace of mind knowing that your personal and financial information is protected. Furthermore, using a prepaid Visa card can also help you earn rewards and discounts on your purchases.

Many prepaid card issuers offer perks such as cashback, points, or discounts at participating retailers, which can help you save money and maximize your spending power in the long run. Overall, shopping with a prepaid Visa card can be a convenient and cost-effective way to make purchases, both big and small. Whether you are buying groceries, clothes, electronics, or anything in between, having a prepaid Visa card in your wallet can simplify the shopping process and help you make the most out of your money. So next time you head out to the store or browse online for your favorite items, consider using a prepaid Visa card to maximize your spending power and enjoy a hassle-free shopping experience. With its convenience, security, and money-saving benefits, a prepaid Visa card can be a valuable tool for smart and savvy shoppers everywhere.

In conclusion, utilizing a prepaid Visa card can be a convenient and effective way to manage your spending and budget more efficiently. With the ability to easily load funds and control your expenses, you can maximize your purchasing power while avoiding debt and overspending. Whether you’re looking to stick to a strict budget, safeguard against fraud, or simply enjoy the convenience of a credit card without the risk, a prepaid Visa card can be a smart financial tool to help you make the most of your money.

How to choose the right prepaid Visa card for you

Choosing the right prepaid Visa card can make a significant difference in how you manage your finances. With so many options available in the market, it can be overwhelming to select the one that best suits your needs. Here are some factors to consider when choosing a prepaid Visa card: First and foremost, determine how you plan to use the card. Are you looking for a card to use for everyday purchases, or do you need it for specific purposes such as international travel or online shopping? Understanding your spending habits and preferences will help you narrow down your options and choose a card that aligns with your needs. Next, consider the fees associated with the card. Some prepaid Visa cards charge a monthly maintenance fee, transaction fees, ATM fees, and reload fees.

Make sure to read the terms and conditions carefully to understand the fee structure and determine if it fits within your budget. Look for cards with transparent fee structures and minimal charges to maximize your spending power. It is also essential to look for features that are important to you. For example, if you travel frequently, look for a card that offers travel insurance, roadside assistance, or purchase protection benefits. If you want to build credit, consider a prepaid Visa card that reports your payment history to credit bureaus. Take the time to research different card options and compare their features to find the one that offers the benefits you value the most. Another factor to consider is the card’s security features. Look for a prepaid Visa card that offers fraud protection, zero liability for unauthorized transactions, and secure online account management.

These features can help safeguard your funds and protect you from potential losses due to identity theft or fraud. Furthermore, consider the card issuer’s reputation and customer service. Choose a prepaid Visa card from a reputable financial institution that has a track record of providing quality services and support to its customers. Read reviews and testimonials from other cardholders to get a sense of the issuer’s reliability and commitment to customer satisfaction. Lastly, make sure to review the card’s reload options and accessibility. Some prepaid Visa cards offer multiple ways to reload funds, such as direct deposit, bank transfers, mobile check deposits, or in-person cash reloads. Choose a card that provides convenient and hassle-free reload options to ensure you can access your funds easily and efficiently. In conclusion, selecting the right prepaid Visa card requires careful consideration of your spending habits, fee structure, features, security, issuer reputation, and reload options. By taking the time to research and compare different card options, you can maximize your spending power and make the most of your prepaid Visa card. Choose a card that aligns with your financial goals and preferences to help you manage your finances effectively and confidently.

Managing your budget effectively with a prepaid Visa card

Managing your budget effectively is crucial to reaching your financial goals. One tool that can help you stay on track is a prepaid Visa card. Unlike a traditional credit card, a prepaid Visa card allows you to spend only the amount of money that you have loaded onto the card in advance. This can be a great way to avoid overspending and keep your budget in check. One of the key benefits of using a prepaid Visa card to manage your budget is that it can help you stick to a set spending limit. By loading a specific amount of money onto the card, you are limiting yourself to only being able to spend that amount.

This can prevent impulse purchases and help you avoid going over budget. Additionally, a prepaid Visa card can also be a useful tool for tracking your expenses. Most prepaid cards come with online account management tools that allow you to monitor your spending in real-time. This can help you see where your money is going and identify any areas where you may be overspending. Another advantage of using a prepaid Visa card is that it can help you avoid accruing debt. Because you are only able to spend the money that you have loaded onto the card, you do not have the ability to carry a balance or accumulate interest charges like you would with a traditional credit card. This can be especially helpful for those who are trying to get out of debt or rebuild their credit. Furthermore, a prepaid Visa card can also be a safe and convenient way to make purchases.

You can use the card for online shopping, in-store purchases, and even to pay bills. Many prepaid cards also come with fraud protection features that can help safeguard your money in the event that your card is lost or stolen. In addition to these benefits, using a prepaid Visa card can also help you build good financial habits. By only being able to spend what you have loaded onto the card, you are forced to be more mindful of your purchases and make more conscious spending decisions. This can help you develop a stronger sense of discipline when it comes to managing your money. Overall, a prepaid Visa card can be a valuable tool for managing your budget effectively. By setting spending limits, tracking expenses, and avoiding debt, you can maximize your spending power and work towards achieving your financial goals. So if you are looking for a way to stay on budget and make smarter financial decisions, consider using a prepaid Visa card to help you take control of your finances, Buy Best Prepaid Visa Card.

Safety and security features of prepaid Visa cards

When it comes to managing your finances, safety and security are top priorities. Prepaid Visa cards offer several features to help safeguard your money and personal information. One key aspect of prepaid Visa cards is that they are not linked to your bank account. This means that if your card is lost or stolen, the thief cannot access the funds in your bank account. You can simply report the card as lost or stolen and have it deactivated without affecting your other accounts. Additionally, prepaid Visa cards have built-in fraud protection measures.

Visa has a zero liability policy, which means that you won’t be held responsible for unauthorized charges made with your card. If you notice any suspicious activity on your account, you can report it to the card issuer and they will investigate the matter. Many prepaid Visa cards also offer the option to set up alerts for transactions. This allows you to receive notifications via text or email whenever a purchase is made with your card. If you see a transaction that you didn’t authorize, you can take immediate action to protect your funds. Another security feature of prepaid Visa cards is the ability to set spending limits.

You can preload a specific amount onto the card, limiting the risk of overspending. Once the funds are used up, you can reload the card with more money as needed. Prepaid Visa cards also offer secure online shopping capabilities. When making purchases online, you can use a virtual card number instead of your physical card number. This helps protect your personal information from falling into the wrong hands. Furthermore, prepaid Visa cards are issued with EMV chip technology. These chips add an extra layer of security to in-person transactions by creating a unique code for each purchase. This makes it more difficult for fraudsters to clone your card or make unauthorized transactions. In the event that you do encounter any issues with your prepaid Visa card, most issuers offer round-the-clock customer support. You can easily reach out for assistance with any questions or concerns about your account.

Buy Prepaid Virtual Visa Card

Buy Best Prepaid Visa card is a card that does not itself issue credit or debit cards but partners with financial institutions that issue cards. Prepaid Visa Credit card bears the Visa symbol.

Visa’s journey begins in 1958, and it was established by Bank of America who launched the first consumer credit card program for middle-class consumers and small to medium-sized merchants in the U.S. It took quite a short time for the company to grow and the company expanded internationally in 1974.

In 1975, it introduced the debit card. Regional businesses worldwide were merged to form Visa Inc. in 2007, and the company went public in one of the largest IPOs in history in 2008. Visa also completed the acquisition of Visa Europe in 2016.

With more than 200 countries and territories with products and services available on any device such as cards, laptops, tablets and mobile devices visa simply is the best way to pay and be paid, for everyone, everywhere.

Advantages of Prepaid Visa Card

- For Visa cardholders, Cardholder Inquiry Service provides customer phone support for general inquiries and provides product or service information.

- Provided by Visa Global Customer Care Services, Visa offers 24-hour cardholder information and assistance by phone to all Visa cardholders calling from anywhere in the world.

- Visa will block your card when the card number is known and connect you with your financial institution or Bank. After bank approval, cardholders can also get an emergency card replacement within one to three business days. There is another option that Visa can arrange for cash to be available at a location near you, usually within hours of your bank’s approval.

- Visa Card also has the facility of receiving auto coverage for damage due to collision or theft.

- Visa’s Zero Liability Policy protects you from unauthorized charges if your card is lost or stolen. Whether the purchases occurred online or in person, you are 100% protected.

- With Continuous fraud monitoring service, Visa monitors activity on your card around the clock to help detect suspicious activity.

- For Visa cardholder, you have access to Roadside Dispatch which is a pay-per-use roadside assistance program.

- Your card includes a 3-digit security code which is to verify your identity for phone or online purchases.

- You can Call anytime for Travel or Emergency Assistance, available for covered Visa cardholders from anywhere in the world.

- With the help of Prepaid Visa Card, you can get a detailed yearly report of your card spending to simplify budgeting and financial planning.

Key Benefits of Our Visa Account

Buy a Visa account with the best quality! We ensure an active and authentic account according to your demand. You can get the following benefits from our service-

-

- Card Anonymity – You can register under any name and address which allows you to keep your personal information hidden.

- Instant 1/2 Delivery – We provide the account right after your payment. So, you don’t have to wait for days to get your account verified.

- Worldwide Access – You can purchase from anyplace through our online service. We also accept all types of currency.

- We offer all types of Visa card accounts. Like Blue card account, Green card account, Brown card, and Black card account.

- Expiry date: The account will belong to you and you have access as long as you want. The card usually has an expiry date of 18-24 months. Sometimes it varies.

Prepaid virtual Visa cards are usually available for purchase online from various issuers or financial institutions. You can often obtain them without a credit check or bank account.

$5000 Prepaid Visa Card Great Delivery Web site, Thanks http://www.vccplus.com

We are ready to give the best service, thank you sir.

I’ve bought a lot of Prepaid Visa Card on this website, it really is trustworthy ! I’ve always received the Card right after I payed them !

I am a USA resident, I am a working person, I shop for our family online from my home, I needed a loaded card for my online shopping, I found this VCC after a lot of searching, I saw their card on this web site and many web sites. No, then I spoke to them on Telegram and loaded $44000, and requested them that we can order from the web site to release more loaded cards, they said they would release the card web site sequentially in a few days, I said. Want to order from home for any online shopping you can buy Prepaid Visa Card from this website, they keep the card confidential and send through mail, best wishes for your organization from us,